What are the Macro-Trends for 2020 in Open Innovation?

Mind the Bridge and Nesta interviewed the top 36 CIOs and Heads of Innovation participating in the Open Innovation Forum held in December during the Scaleup Summit in Madrid

Open Innovation and startup-corporate collaboration: what to expect in 2020? Mind the Bridge and Nesta asked 36 global CIOs and Heads of Innovation participating in the Open Innovation Forum held in December in Madrid during the Scaleup Summit.

DOWNLOAD THE FULL REPORT FOR FREE

Here are the most notable trends for 2020 in corporate-startup collaboration:

1. Procurement will continue to be the predominant mode of corporate-startup engagement.

96% of Corporate Startup Stars will continue to commercially engage startups through funded POCs (proof of concepts) and pilots. Co-development via so-called “startup studios” is on the rise too (87% of the respondents)..

2. We see a growing appetite for startup acquisitions, while investments in startups remain strong.

80% of Corporate Startup Stars are planning to acquire startups in 2020 (versus 74% in 2019). 83% of Corporate Startup Stars will continue to invest into startups.

3. Corporate Startup Accelerators are losing momentum.

More companies are abandoning/downsizing their startup accelerator programs. It is a clear trend now (down from 83% in 2019 to 80% expected in 2020).

4. Having an innovation outpost in Silicon Valley and Israel is now a must.

65% of Corporate Startup Stars will have an innovation presence in Silicon Valley (up from 57% in 2019). 52% of Corporate Startup Stars are planning to put innovation boots on the ground in Israel (up from 48% in 2019)

“The approach to Open Innovation is definitively evolving over time – commented Alberto Onetti, Chairman of Mind the Bridge and SEP Coordinator – While a few years ago the main goal of companies was to communicate their activities in support of innovation, targeting attention from the media and, generally, their startup-friendliness, today it is all about producing collaborations with startups that have an impact on the company’s EBITDA. In this perspective we identified an evolutionary framework based on 3 Open Innovation eras: the Age of Marketing, the Age of Collaboration and the Age of Results”.

Where do Corporate Startup Stars go hunting for innovation?

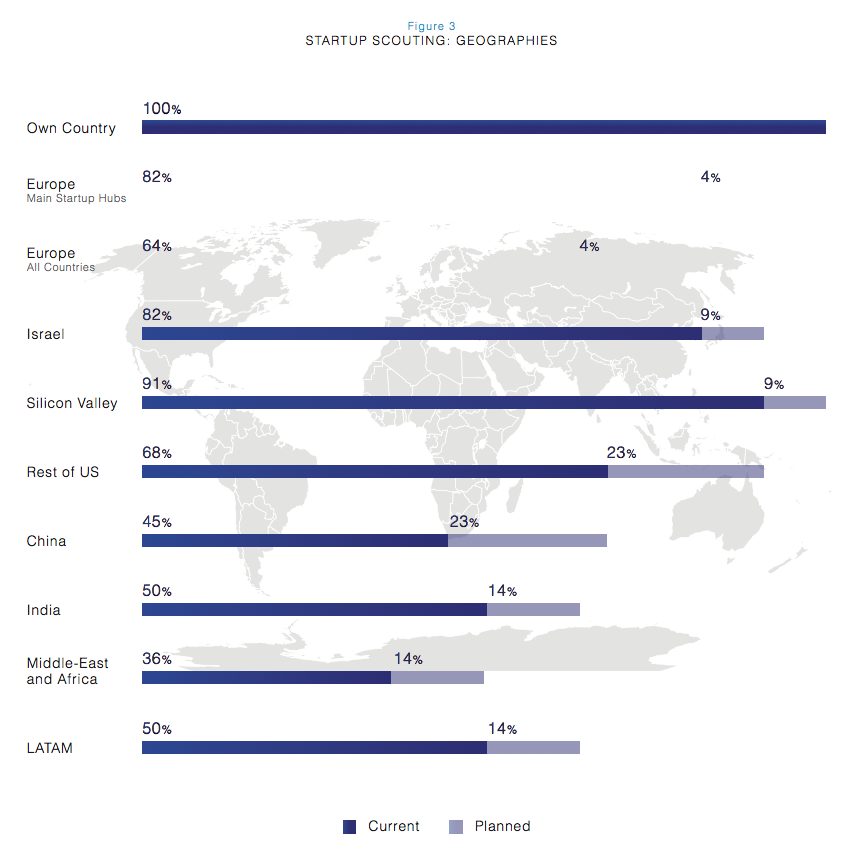

Beyond their home country (100%), the Corporate Startup Stars are focused on the main world’s technology hubs:

- First and foremost, Silicon Valley (91% are already active, the remaining 9% are planning to in the near future)

- Israel and the top European clusters (London, Paris, Berlin) follow (82%).

Outside of the main hubs above, there is not yet enough critical mass of mature startups to justify dedicated scouting investments.

- Approximately two thirds have expanded the scouting effort to the rest of the United States and Europe and 50% in LATAM, India and China.

- Middle-East and Africa are currently still off radar (“only” 36% scout there).

“Not surprisingly Silicon Valley and Israel attract the interest of almost all the innovation leaders – commented Alberto Onetti, Chairman of Mind the Bridge and SEP Coordinator – Scouting produces results where there is a strong concentration of mature startups – aka scaleups. Europe – except for a few main hubs – China, India have not yet reached a critical mass both in terms of volume and quality. But we see a growing interest in looking at these geographies”.

Startup-Corporate Engagement: Main Barriers to Overcome

What are the main obstacles to turn open innovation into action and produce results?

- The main barriers to startup-corporate collaboration are mostly internal.

Key barriers to implementation are rigid processes (68% of the respondents), lack of resources (budgets and teams for open innovation are considered insufficient by 41% of respondents) and scarce involvement of the business units (41%).

Corporate culture of risk aversion (plus lack of internal entrepreneurial culture) are the main reported cultural obstacles to innovation. - On the external side, the current economic climate is apparently not going to impact the growth of open innovation.

- Similarly political uncertainty (including BREXIT) doesn’t seem to have an impact.